Gold Prices Fall Amid Easing Trade Tensions.

Gold prices have declined due to easing trade tensions between the U.S. and China

Gold prices dropped nearly 1% on Tuesday due to easing trade tensions between the U.S. and China, which reduced demand for safe assets. At the same Time, investors are awaiting the release of important economic data this week that will help gauge the future policy of the Federal Reserve, Reuters reports.

Decrease in Gold Prices

Spot gold prices fell nearly 1% to $3,314.26 per ounce. U.S. gold futures dropped by 0.7% to $3,325.

'There is a certain optimism regarding a possible easing of the trade war between the U.S. and China,' noted David Meger, director of metals trading at High Ridge Futures.

Easing of Auto Tariffs

President Donald Trump's administration plans to ease the impact of auto tariffs by reducing taxes on foreign components used in American cars, as well as ensuring that several tariffs are not applied simultaneously to imported cars.

Consequences of Easing Trade Tensions

Easing trade tensions have led to a sell-off of gold as a traditional safe haven asset, which reached a record high of $3,500.05 per ounce last week.

Good Offers from Trading Partners

U.S. Treasury Secretary Scott Bessen stated on Monday that several key trading partners have made 'very good' offers to avoid U.S. tariffs. Recent actions by China to exempt some American goods from tariffs indicate a willingness to reduce trade tensions, Bessen added.

Expectations for U.S. Economic Data

Investors are now awaiting a series of important U.S. economic data this week, including the Personal Consumption Expenditures Price Index on Wednesday and the monthly employment report in the non-farm sector on Friday.

'Looking at the short term, the key level is $3,500, where we could see people start to close positions, this is a normal market fluctuation,' said Michael Matousek, chief trader at U.S. Global Investors.

'The end of the quarter could drive gold prices to $3,590. I would project a price of $3,800 per ounce by the end of the year,' he added.

Other Metals

Silver prices remained unchanged at $33.2 per ounce, platinum fell by 0.9% to $977.49, and palladium dropped by 1.7% to $933.10.

Read also

- Gold worth 78 billion dollars - where a unique deposit was discovered

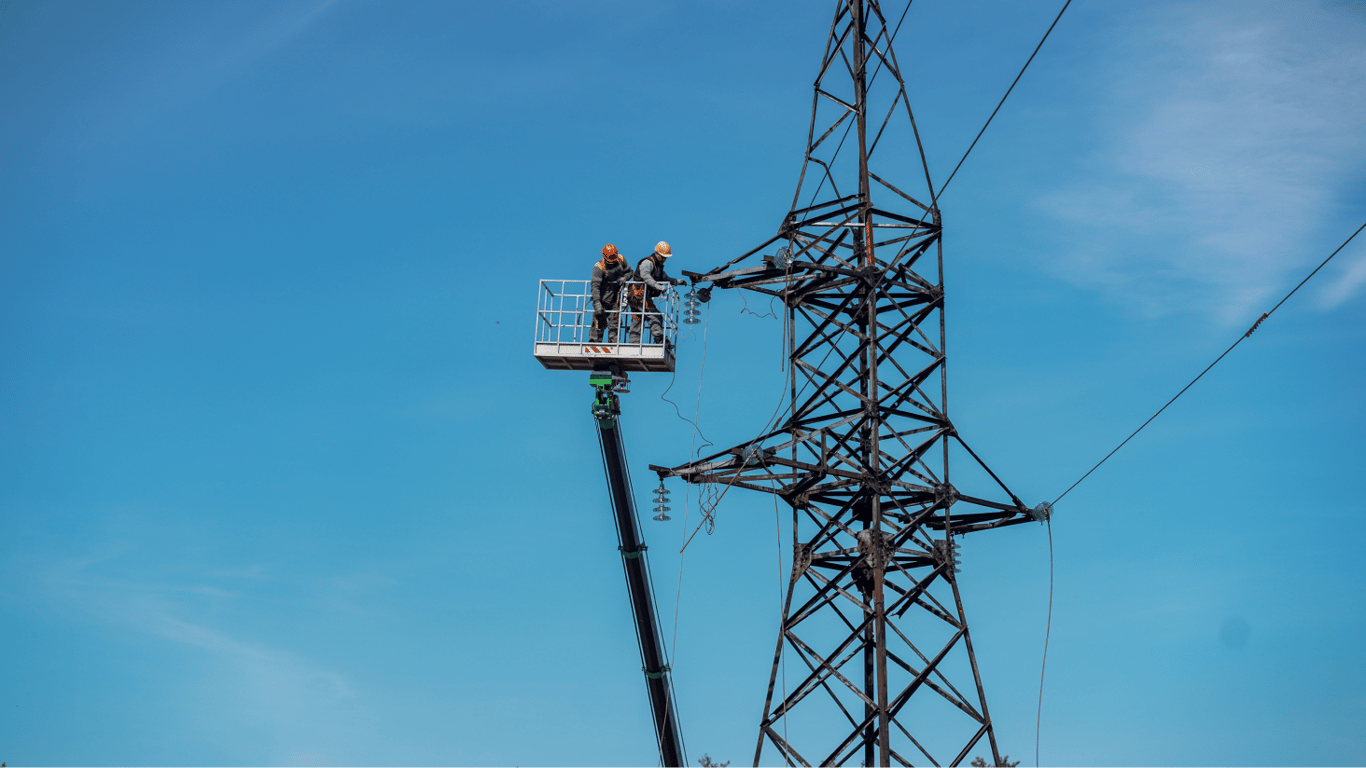

- Ukrainians explained why electricity outages are possible in summer

- Apartment prices have changed - where is the cheapest housing in Ukraine

- Ordering cards from PrivatBank — customers were warned

- Logistics of the Future - a Network with Ukraine, Moldova, and Romania

- Grain Prices in July - Which Crop Can Bring Profit