The State Treasury has lost 61 billion UAH in VAT.

The annual VAT collection plan for 2024 has been fulfilled at 92%, which is 61 billion UAH below the planned amount.

The analytical department of Forbes Ukraine reports that the collection plan for many key taxes has not been fulfilled in 2024.

The largest shortfall in the annual plan has been recorded in the area of rent payments for the extraction of mineral resources, where the deviation amounted to 12% or 6 billion UAH in monetary terms.

The largest amount of non-payment was identified in the area of VAT. The annual VAT collection plan for imported goods was not fulfilled by 40 billion UAH (8%), while domestic VAT was not fulfilled by 21 billion UAH (7%).

Due to the late entry into force of the law, 10 billion UAH or 4% of the annual plan for personal income tax and military tax was not paid into the general fund.

Corporate profit tax exceeded the plan by 31 billion UAH or 13%, mainly due to the 50% tax rate for banks.

The excise tax collection was exceeded by 3%, or by 6 billion UAH.

Read also

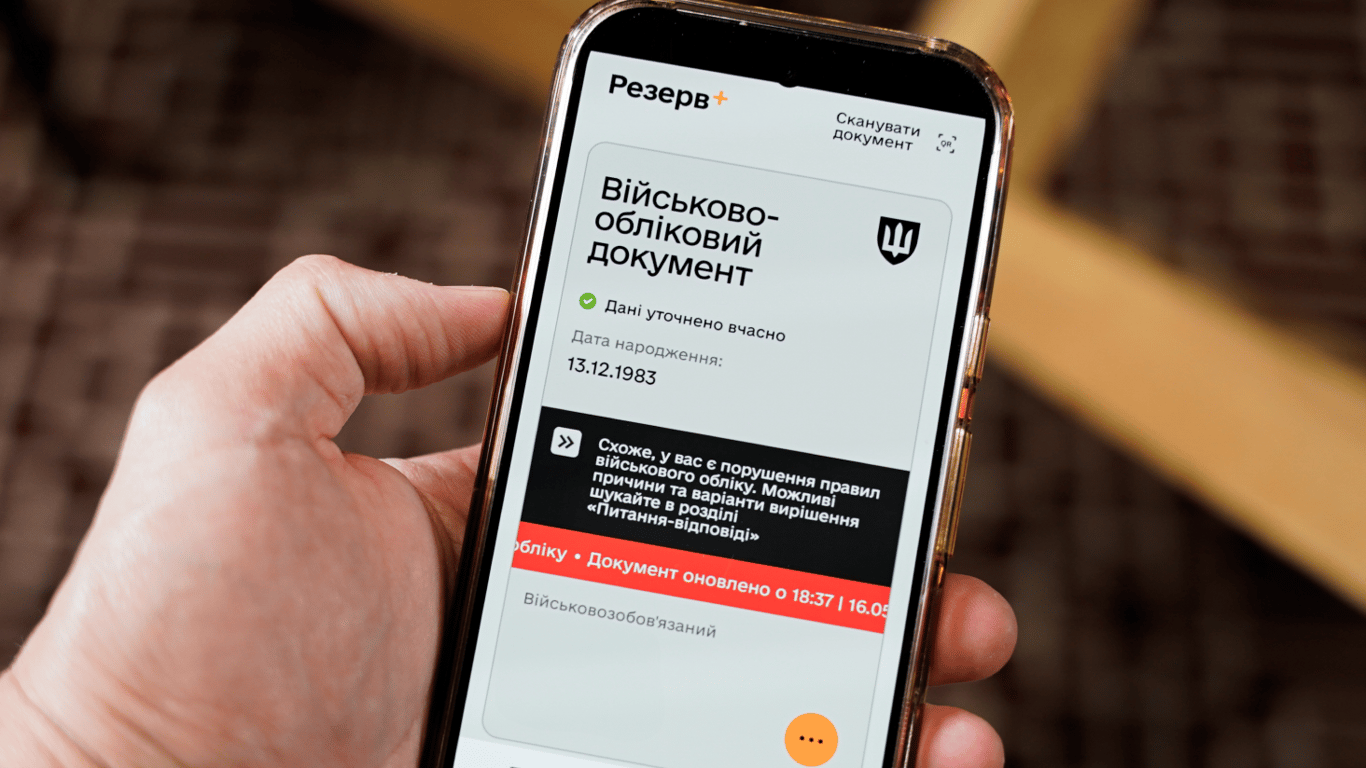

- When to Ignore Notifications of TCC Fines

- Ukrainians are guaranteed social assistance instead of a pension — what are the conditions

- Clients of Oschadbank in Occupation Lost Access to Accounts - Details

- Who the Territorial Recruitment Centers will not be able to fine from July 17

- Taiwan Prepares for Urban Combat with China - How the Drills Took Place

- 100 billion euros to aid Ukraine – when will the EU allocate this money